Explore the Highlights of SFR’s 2025 Institutional Investment Study

On Thursday, November 27, we celebrated the 26th edition of the SFR Institutional Research at the results gala in the stunning Astoria Hall. The event brought together over 100 investment professionals to discuss current themes in institutional investing. We would like to thank all participants and our event partner Impact Cubed for helping us create this memorable occasion.

The evening was full of inspiring discussions as we explored the most interesting findings from the 2025 study, investing in the age of AI, and the development and future challenges of private investment markets. In this blog post, we share highlights from the event and present some intriguing insights from this year’s research.

SFR Research is an independent research company founded in the early 1990s, and we offer high-quality institutional investment and capital market research for the benefit of the entire wealth management and investor community. Our esteemed research is based on long-term trust and cooperation with the investors we interview. Check out all our studies here!

Images 1 and 2 - Gala

What is Institutional Investment Services Programme?

The Institutional Investment Services Programme, or ISP survey, is an in-depth interview survey conducted regularly since 2000, in which approximately one hundred of Finland's key institutional investors participate annually. The study provides a unique perspective on the Finnish institutional market and analyses, for example, investor allocations, the use of investment instruments and future trends. In addition, we investigate investors' experiences of the operations of different service providers and the reasons behind asset manager choices.

Our goal is to strengthen and streamline the market to make it easier for investors to find the most suitable partner and to enable asset managers to meet investors' needs with increasingly high-quality services. You can read more about the study here.

What Does Institutional Investing in Finland Look Like in 2025?

According to SFR Research’s Head of Research, Iiro Nikander, the multi-phase investment year of 2025 seems to be ending under the same uncertain conditions as it unfolded. The global geopolitical power play is likely to keep investors on their toes going forward.

In equity investments, Finnish institutional investors currently emphasize increasing diversification both geographically and across sectors, mainly through passive products. Among geographic regions, Europe stands out more strongly than before, as many respondents allocate funds there while reducing their high U.S. exposure and the share of dollar-denominated investments. However, the United States is still widely perceived as the region from which the largest growth companies will continue to emerge. Unpredictable politics, the impact of import tariffs, high company valuations, equity returns concentrated in mega-tech, and currency risks remain concerns for investors.

The independence of the U.S. Federal Reserve is a particularly hot topic among the most professional investors. Many believe that the status of U.S. government bonds as a safe haven will become more questionable in the future, as indicated by the sharp weakening of the dollar and the rise in gold prices. Fixed-income investing has changed significantly following the zero-interest era and the rate hikes of 2022, and liquidity-based allocation is becoming more common.

Based on the research results, the share of alternative investments in portfolios continued to grow broadly, except for real estate. Among the most professional investors, however, no clear structural need for changes in the weighting of alternatives was observed. In real estate funds, redemption gates have largely remained in place, and market recovery has been slower than expected. In direct real estate investments, some investors feel that exit markets have even deteriorated compared to last year. On the other hand, a small group of investors sees the current market as an excellent opportunity to increase real estate exposure.

Private equity remains attractive to investors, although for many with a longer history in the asset class, the focus was primarily on increasing diversification. Growth in the role of secondary markets was anticipated, and the weakness of exit markets in recent years was seen as offering interesting opportunities for strong managers.

A sluggish year in real estate and M&A markets compared to expectations is making new investments more challenging, and liquidity management has become increasingly important in institutional investment strategies. Evergreen structures (including funds under the revised ELTIF 2.0 framework) are attracting growing interest among institutional investors. The importance of a thorough due diligence process will continue to increase, and investors must ensure visibility into the valuation basis of underlying assets, actual liquidity, and realistic return expectations.

Award Winners of 2025

Images 3, 4, 5 and 6 - Award Winners 2025

Every year, we recognize the top-performing service providers in our survey. These providers are divided into three categories based on their market penetration and product range. Large category includes the providers with the highest market penetration, while Challenger category features providers with smaller market shares in our survey. Specialist category highlights providers that focus on specific asset classes.

The awards are based on evaluations given by institutional investors participating in the survey. Investors rate their service providers on a scale of 1 to 5 across various criteria, and every investor's ratings carry equal weight regardless of the size of their assets or the chosen asset management model. Pension funds, non-life insurance companies, and life insurance companies do not provide ratings for their service providers due to their internal operating models. You can read more about the methodology on our website here.

In 2025, Nordea achieved the highest score in the Large category and was awarded the SFR Platinum Award. Evli secured second place, while OP Asset Management and Danske Bank shared third place with equal points. In the Challengers category, we awarded United Bankers for achieving the highest score, and in the Specialist category, Schroders took the win, earning praise for its liquid funds.

We also recognized the providers with the highest ESG scores in the Large category, which this year were Nordea and SEB, tied for first place. In addition, we presented an award to the top performer in alternative sub-asset classes, which this year was SEB in Private Equity. You can explore all the award winners in detail here.

Investing in the Age of Artificial Intelligence

The results gala program featured two excellent panel discussions that sparked lively debate and offered participants inspiring new ideas. In the evening’s first panel, we dove into investing in the age of AI, with expert insights from Jyri Engeström (Partner, Lifeline Ventures), Ruth Kaila (University Teacher, Aalto University), and Tony Nysten (Partner, OpenOcean). The discussion was moderated by SFR’s own Hannu Huuskonen.

Images 7 and 8 - Panelists: Ruth Kaila, Tony Nysten and Jyri Engeström.

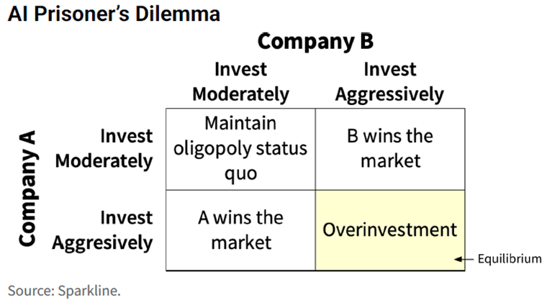

Kuva 9 - AI Prisonder's Dilemma

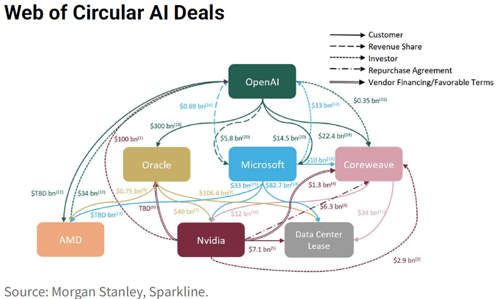

Kuva 10 - Web of Circular AI Deals

As the discussion progressed, Hannu asked whether the AI boom could create systemic risks, and Jyri’s answer was clear: yes, it could. According to him, expectations around AI are currently exceptionally high, and many believe that in the near future, AI will do far more on behalf of humans than it does today. However, Jyri reminded the audience that similar expectations have proven overly optimistic before. For example, self-driving cars were predicted to become widespread 10–15 years ago, yet progress has been much slower. When expectations are not met quickly enough, disappointment can trigger significant risks across the system.

One of the themes of the discussion was the geopolitical dimension of AI. Ruth highlighted how the AI race between the United States and China has also contributed to market bubbles. She noted that AI can serve as a tool in states’ broader pursuit of power and pointed out that, at present, China is able to leverage AI better than the West. China’s advantages include access to massive datasets from its own citizens as well as data from Western users through apps like TikTok. Ruth mentioned that she personally uses apps from Western service providers.

Finally, the panelists were asked whether they currently see innovations in development that could completely transform the investment industry. Tony stated that while many projects are underway, in his view, other industries are likely to experience greater disruptions before the investment sector does. Jyri, on the other hand, noted that blockchain technology is talked about less these days, but a more fundamental disruption could potentially come from there. He also suggested that if the AI bubble bursts, the industry should be allowed to develop quietly for a few years, after which truly significant and useful innovations could emerge.

Private Markets: From Satellite to Core

The topic of the evening’s second panel discussion was the development, challenges, and future of private investment markets. The panel featured experts Kari Vatanen (Head of Asset Allocation and Alternatives, Elo), Tiina Smolander (Portfolio Manager, Equity and Fixed Income, Sitra), and David Merton (Head of Portfolio Management, Fulcrum Asset Management). The discussion was moderated by Hamed Salehi (University Lecturer, Aalto University).

Images 11 and 12 - Panelists: Kari Vatanen, Tiina Smolander and David Merton. Moderator: Hamed Salehi.

At the start of the discussion, moderator Hamed Salehi described how private markets have gained popularity among investors over the past two decades. For example, in Finnish pension insurance companies, the share of private equity in portfolios was just over one percent in 2005, but now it is approaching 20 percent. Kari continued on the topic, outlining the development of private markets and their different phases during his career. He explained how the IT bubble at the turn of the millennium did not hit the private side as hard as listed equities, since valuations in private markets did not inflate in the same way. After the financial crisis began the era of zero interest rates, when investors shifted from poorly performing traditional instruments to better-yielding private market products, significantly boosting their valuations. Now the situation has changed: interest rates are positive again, and there is no return to zero in sight. This means that invested capital must generate returns within a certain time frame. Kari expressed concern that not all private market products will necessarily meet investors’ return expectations, which could lead to challenges.

The discussion raised the question of whether investing in private markets provides genuine diversification for a portfolio. Tiina explained that their portfolio at Sitra is broadly diversified across different private markets, and she believes they offer significant additional diversification. One reason, she noted, is that the drivers of return and risk in private markets differ partly from those in listed markets. David, in turn, emphasized that by investing only in listed markets, investors miss out on a vast range of opportunities. In his view, private markets definitely add diversification to a portfolio, even though, for example, private credit and private equity may correlate to some extent.

One of the key themes of the discussion was the rise of evergreen and, more broadly, semi-open fund structures alongside traditional closed-end funds. According to Kari, there are both pros and cons, and he described the differences between the funds: evergreen funds continuously raise capital and aim to allocate it efficiently, while closed-end funds call capital in stages as suitable opportunities arise. He noted that closed-end funds can optimize return calculations and thus use a higher internal rate of return (IRR). Tiina, however, pointed out that IRR is not the best metric for closed-end funds and also highlighted the liquidity challenge of evergreen funds. In private equity, the typical investment horizon is about seven years, but if a fund promises three-month liquidity, this creates a significant contradiction in the market. She summed up the potential problem aptly: “The fund has liquidity—until you need it.”

Take a look at the highlights from the evening in our video!

Interested in our research?

Our research provides unique and in-depth information on the investment activities and market development of Finland's most significant institutional investors. Our customers use our reports in a variety of ways, for example, to develop their product portfolio, improve the quality of services and understand the market. Our service helps them stay one step ahead of the competition and make decisions based on both trends and investor needs.